Lease Accounting Rules Trigger Changes in Fleet Management

What Spurred These Changes?

Since the Enron scandal in 2001, where executives made the company appear stronger than it was by omitting some financial obligations from the balance sheet, accounting boards have been working to update and improve the transparency of accounting standards. One area needing improvement was the transparency of operating leases. As it stands right now, companies are only required to state lease obligations in the footnotes of their financial statements, which is clearly out of the spotlight.

Investors and regulators, alike, have been pushing for improved reporting of an organization’s leasing activities. Currently, these types of leases are not reported on the balance sheet, making it difficult for investors to view the entire picture. Although these leases are reported in the footnotes, the typical investor does not pay much attention to this section. The new accounting rule will assist the typical investor in obtaining a more complete view of the company’s true financial obligations.

Many companies will be affected by this new rule, especially retail chains that lease real estate for their stores, airlines who lease planes, and large construction companies who lease trucks and other expensive equipment. These companies typically have long-term lease agreements for large amounts.

According to James Kroeker of the FASB, “(The new rule) adds light to one of the last remaining crevasses of off-balance-sheet accounting.”

Operating Lease vs. Capital Lease

Most leases are operating leases. This type of lease is treated like renting, where payments are considered operational expenses. Currently, the asset being leased does not need to be reported on the balance sheet. That will change in 2019.

Capital leases, on the other hand, are currently being accounted for on the balance sheet. Capital leases differ from operating leases because companies can typically gain ownership of the asset once the lease is through. This is not the case with operating leases, where it gives the company the right to use an asset.

What Does it Mean for Your Company?

No more off-balance sheet accounting for lessees. All lease types, finance and operating, will need to appear on the balance sheet. Furthermore, lessees will need to include a “right-of-use” asset and a lease liability. The specifics will depend on the structure of the lease.

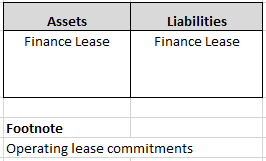

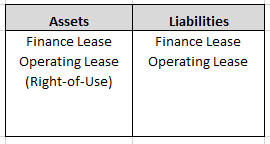

Here’s a quick comparison of how a balance sheet looks today and how it will look once the changes go into effect:

[/fusion_text][fusion_text]

Current Balance Sheet

Future Balance Sheet

What can fleet professionals do to get ready?

If you are in fleet management, there are several things you can do to prepare for these upcoming changes including connect with your finance team, review current business operations, and work with your external auditors.

The first place to start is with your finance team. You’ll want to contact the control and reporting part of the finance team, as they are typically the ones that deal with this part of accounting. Be sure to ask them what information they need from you to prepare for these upcoming changes.

Next, you will want to ensure that there are systems and processes in place that allow reporting for any type of lease. Make sure these are in place well ahead of time – it’s no fun to scramble as the deadline approaches.

Third, review your current business operations. These include contracts with your current fleet provider, data from your fleet provider, and controls and systems for your fleet.

Finally, it’s important to work with your external auditors, as they are the ones ultimately responsible for the balance sheet reporting. Your auditors are a great source of guidance to interpret and define these new rules.

Important Dates to Know

The new standard on leases, released by the FASB on February 25, 2016, include the following effective dates:

- December 15, 2018 (Annual Periods) / January 1, 2019 (Calendar Periods) – For public business entities

- December 15, 2019 (Annual Periods) / January 1, 2020 (Calendar Periods) – For all other entities

It should also be noted that early adoption is allowed for all entities. Mark your calendars and be prepared well ahead of time!

Benefits of Leasing/Renting

Even with the new accounting rules, there are many benefits to leasing and/or long-term renting:

- Keep cash in your business. If you rent or lease, you can keep more cash on hand than if you were to buy. No large down payments or cash expenditures.

- Only pay for the usage of the vehicle. Use the vehicle for a specified length of time, then hand over the keys.

- Renting doesn’t tie up your line of credit. But if you were to buy and make payments, that will show up on your credit report.

- Not investing in a depreciating asset. If you buy a vehicle, the second it is purchased it becomes a depreciating asset.

- Cycle your vehicles at the best time. By leasing/renting your vehicles, you are sure to have the latest, cleanest, and best performing vehicles on the market.

- Reduce your administrative burden. No need to have a separate purchasing and selling organization. And, consolidated monthly billing from one vendor.

How Summit Fleet Can Help

According to the new guidance released by the FASB, a “lessee will be required to recognize assets and liabilities for leases with lease terms more than 12 months.” So, any lease or rental with terms less than one year will be exempt from this rule. Summit Fleet does not “lease” its truck inventory, but rather rents for long term. The term typically ranges from four to nine months.

What does this mean for you and your accounting department? If you rent through Summit Fleet, you will not need to include this on your balance sheet. However, if you lease your vehicles longer than 12 months, you will need to.

Janelle Cridland, Senior Accountant at Summit Fleet LLC, weighed in on the topic and said, “More and more companies that currently buy or lease vehicles for longer than a year, will see the benefits of renting their fleet and will likely make the switch. From a finance and accounting perspective, renting vehicles is a no-brainer.”

Summary

Although the new accounting rule does not go into effect until 2019/2020, it is wise to start taking the appropriate steps to ensure your organization is prepared ahead of time. To get ready for the change, connect with your finance team, review your current business operations, and work with your external auditors. At that point, you may decide that renting all or part of your vehicle fleet makes more sense than leasing long-term or buying – it’s definitely worth checking in to.

Sources:

https://www.wsj.com/articles/new-rule-to-shift-leases-onto-corporate-balance-sheets-1456414200

https://www.nytimes.com/2016/02/26/business/dealbook/accounting-of-company-leases-required-by-new-rule.html?_r=1

www.us.leaseplan.com